georgia estate tax laws

The Georgia gift and estate tax is an annual tax on transfers of property. The assessed value--40 percent of the fair market value--of a house that is worth.

Does Georgia Have Inheritance Tax

Recording Transfer Taxes.

. Estate taxes are only mandated in a handful of states and thankfully there is no Georgia inheritance tax. Georgia law states that the estate. The lifetime exemption amount for a Georgia gift or estate is 15000 for each giver and recipient.

Senate Bill 177 Act 431 was signed April 30 1999 and became effective January 1 2000. If a person that owned a home with a fair market value of 100000 in an unincorporated area of a county where the millage rate was 2500 mills that persons property tax would be 95000-. Property Tax Returns and Payment.

Standard Homestead Exemption The home of each resident of Georgia that is actually occupied and used as the primary residence by the owner may be granted a 2000 exemption from. Taxes are unavoidable in any state. Property Taxes in Georgia.

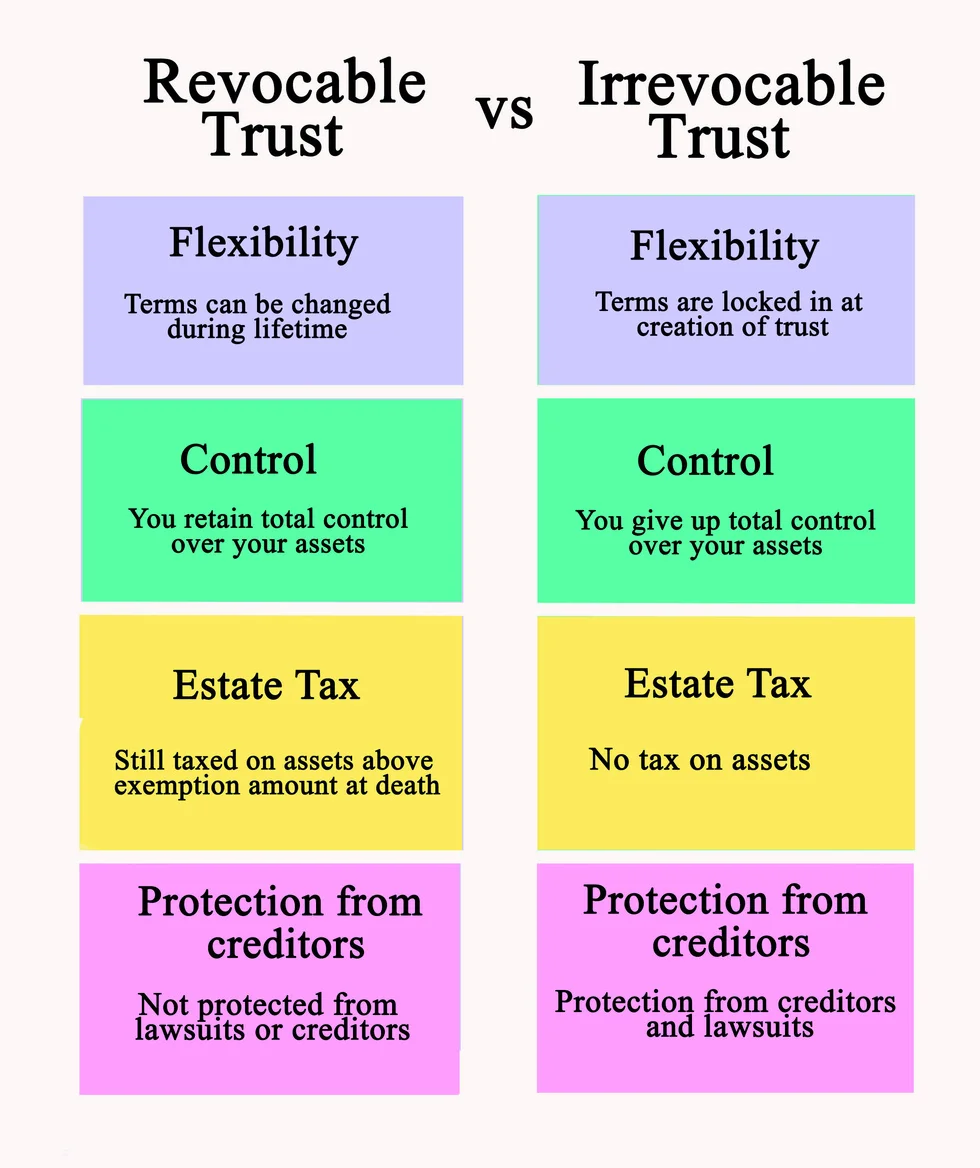

Wills Trusts and Administration of Estates. Any deaths after July 1 2014 fall under these. Under federal tax law estates with fewer than approximately 5 million in assets are not subject to estate taxes.

State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. Property and real estate laws affect renters and landlords as well as home owners or prospective home owners. Wills Trusts and Administration of Estates.

Inheritance taxes apply to the beneficiaries after receiving the money from the deceaseds estate. Sales Use Taxes Fees Excise Taxes. Property Taxpayers Bill of Rights.

The Department issues individual and generalized guidance to assist taxpayers in complying with Georgias tax laws. 48-5-7 Property is assessed at the county level by the Board of Tax. Georgia Code Title 53.

Local state and federal government websites often end in gov. Property in Georgia is assessed at 40 of the fair market value unless otherwise specified by law. The bill has two main thrusts.

Prevention of indirect tax increases. And while no one enjoys paying taxes they help fund important public services such as roads public schools fire departments and other. Due to the high limit many estates are.

Current as of April 14 2021 Updated by FindLaw Staff. Property Tax Homestead Exemptions. Georgians are only accountable for federally-mandated estate taxes.

In Georgia property is required to be assessed at 40 of the fair market value unless otherwise specified by law. Most states including Georgia have homestead protection laws allowing. Georgia law is similar to federal law.

County Property Tax Facts.

:max_bytes(150000):strip_icc()/aa014176-5bfc2b8bc9e77c002630643b.jpg)

Estate Tax Rates Exclusions And Impact On Gift And Inheritance Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What You Need To Know About Georgia Inheritance Tax

State Estate Tax Rates State Inheritance Tax Rates Tax Foundation

Estate Tax In The United States Wikipedia

Georgia Abortion Law Changes Tax Deductions Kiplinger

Georgia Estate Plan Gaestateplan Twitter

Marietta Trust Lawyer What S The Difference Between A Revocable Trust And An Irrevocable Trust Georgia Estate Plan Worrall Law Llc

Guide To Georgia Inheritance Law The Law Office Of Paul Black

:max_bytes(150000):strip_icc()/182667184-56a636213df78cf7728bd987.jpg)

Estate Taxes Who Pays And How Much

Estate Inheritance And Gift Taxes In Connecticut And Other States

A Guide To The Federal Estate Tax For 2022 And 2023 Smartasset

Estate Planning Attorneys In Atlanta Ga Best Estate Planning Lawyers In Atlanta

How The House Tax Proposal Would Affect Georgia Residents Federal Taxes Itep

Estate Taxes Who Pays And How Much

Real Estate Tax Paulding County Treasurer

Estate Plan Secrets How To Avoid Estate Tax Part 2 Of 2

What Are The Costs Associated With Selling A Home In Georgia Brian M Douglas